Used EVs: Still slower to sell in Singapore

11 Jun 2024|20,507 views

Across the globe, we've seen many reports of the resale value of electric vehicles (EVs) plummeting. Across major markets like the U.K., U.S.A and Australia, it appears that used EVs are struggling to find new homes.

Why? Some potential explanations have been floated.

One reason is the rapidly advancing pace of technology, and consequently the rapid improvement of EVs year-on-year. The result is that an EV that's perhaps two to three years old will feel drastically dated compared to contemporary models, in a way that internal combustion engine (ICE) models perhaps would not be.

This can chiefly be chalked up to battery technology. For reference, where EVs would deliver 300 to 400km of range a few years back, today we are seeing EVs capable of 500-700km, and even 400+ on your more entry-level models.

For ICE models, used, five-year old models would typically lose out in terms of equipment and perhaps a little bit of performance, but the car's 'basic' capabilities are largely still on-par. Considering that range is quite fundamental to an EV's capabilities, a significant drop-off in range would certainly give customers pause when buying a used model.

Another reason ca be chalked up to general uncertainty when it comes to EVs. Since EVs are still relatively 'new', buyers may be more cautious about them in the used car market, and may thus still gravitate towards more 'traditional' models.

Models like the Tesla Model 3 and Porsche Taycan are often available in the used car market, but every car's original price (and consequently resale price) fluctuates according to COE

Analysing Singapore

What about Singapore?

For starters, trying to identify and map out the "resale value" of EVs in Singapore is much more complex when compared to other markets, and that's intrinsically tied to the COE system.

In other markets, a car's value is a more straightforward calculation, as the car has more or less a determined 'price', even with taxes factored in.

Here in Singapore, it's not so simple. Because of the fluctuating nature of COE, two identical new cars may in fact have very different 'pricetags' depending on when they were purchased (or registered, to be precise), which thus makes calculating across-the-board value depreciation for any model quite tricky.

Is there a way? There probably is, but it'll requires a hellish amount of math that I'm not sure I am actually able to do.

So, how do we make sense of the used passenger car EV market here?

Taking a look at listings

Thankfully, we have other potential data points, helped in no small part by the fact that Sgcarmart hosts a majority of used car listings (and facilitates a majority of transactions) here in Singapore. This allows us to dig a little deeper into the listings and see if certain patterns emerge.

One option is to look at the average duration of used car listings, and identifying the duration between when a used car is listed, and when it is sold. This can give us an effective idea of how long a car is "on the market" - with the assumption that quicker turnover is indicative of greater buyer demand.

Looking at data from 2023 through to Mar 2024 (based on a car's listed date), there were 905 used EVs transacted on Sgcarmart, with an average duration of 71.8 days between listed date and transacted date, and a median of 48.5.

In the same 15-month period, 90,760 non-electric used cars were transacted, with an average duration of 53.7 days between listed date and transacted date, and a median of 34.

On this data point alone, we can see that turnover of a used EV is considerably longer than a used non-EV, about 33% longer.

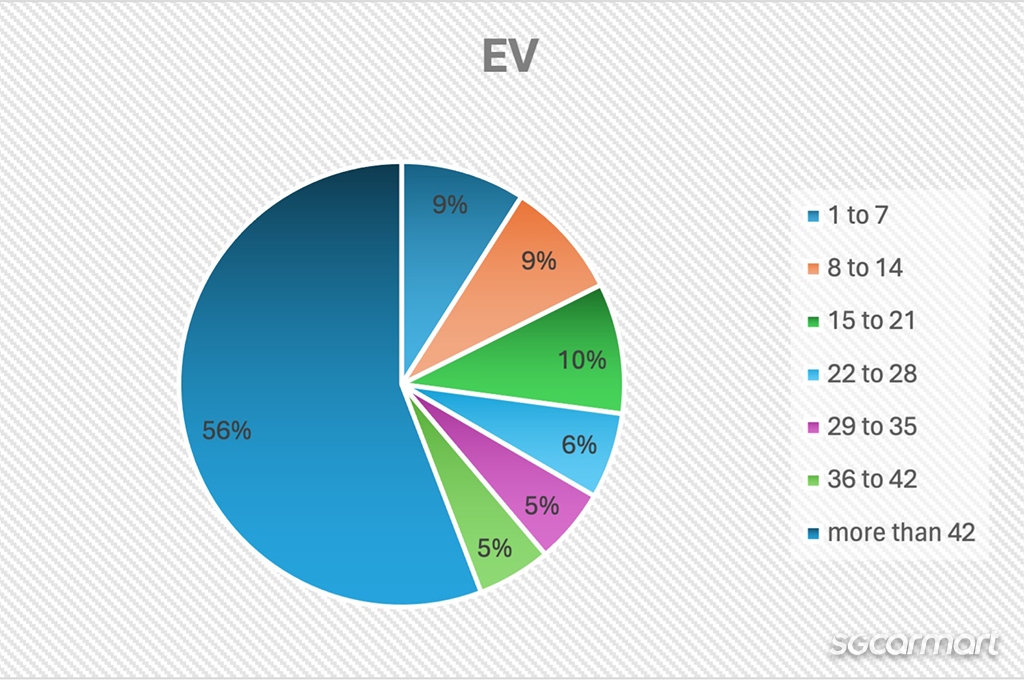

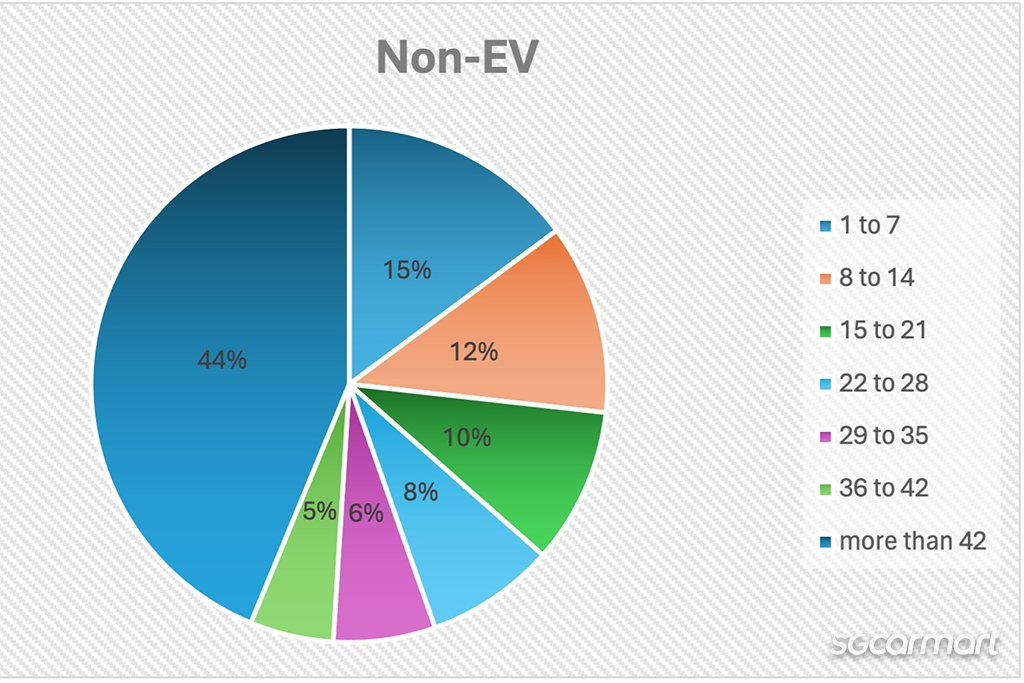

Breakdown of listing duration by number of days

If we look more closely at the data, we can also sort the listings by number of days, grouped into 7-day segments, with an upper bound of 'more than 6 weeks'.

With EVs, we can see that the largest percentage is from 15 to 21 days, with comparable and similar percentages for the '1 to 7' and '8 to 14' segments. Also, less than half of all transactions take place within 6 weeks.

For comparison, for non-EVs, the highest percentage is for the '1 to 7' segment, which indicates much quicker turnover of cars within 7 days of listing. Additionally, more than half of all transactions take place within 6 weeks.

Drawing relevant conclusions

While it's hard to do a direct price analysis of used EVs given the volatile and ever-changing nature of prices and "value", a look at transactions show us that EVs tend to be more 'sticky' on the used car market.

Of course, we do also have to recognise that because of the disparity in size of data sets (there is almost exactly 100x more data on non-EVs), there may be some risk of sample size fallacy.

Representatives from used car dealers Sphere Automobile and SgCarChoice acknowledge that EVs tend to take longer to be sold compared to non-EVs

In speaking to several used car dealers that have EVs in their inventories, the responses have been mixed. Some concur that EVs are generally harder to move compared to non-EVs. Representatives from Sphere Automobile and CarChope SG acknowledge that EV tend to take longer to be sold compared to non-EVs, while a representative from SgCarChoice tells us that “the demand for non-EV used cars is still much higher than EVs”. Several dealers acknowledge that while there is growing demand for EVs, even used ones, concerns about battery life and charging infrastructure are still front-of-mind for customers.

A representative from Octane Motors also highlights a challenge: "The price of a brand new EV unit is very competitive, and it might actually be cheaper buying brand new".

However, several also point out that in the used car market, it's about "matching the buyer to the correct car at the correct price point", true for both EVs and non-EVs. A representative from First Exclusive Motoring tells us that "it seems that EVs have their own target audience […] if the price is right, the turnaround time is about the same as non-EVs".

It's worth considering what this means for Singapore, at least right now in 2024. While we cannot say for certain that used EV values are falling, we can at least statistically acknowledge that EVs are harder to move in the used car market when compared to non-EVs.

Of course, Singapore is still in the relatively early stages of electrification. As more new EVs come to market (and then eventually enter the used car market), and with growing infrastructure availability, we may eventually see this gap narrow. But as of right now, the numbers still indicate that used EVs are slower to sell in Singapore when compared against non-EVs.

Across the globe, we've seen many reports of the resale value of electric vehicles (EVs) plummeting. Across major markets like the U.K., U.S.A and Australia, it appears that used EVs are struggling to find new homes.

Why? Some potential explanations have been floated.

One reason is the rapidly advancing pace of technology, and consequently the rapid improvement of EVs year-on-year. The result is that an EV that's perhaps two to three years old will feel drastically dated compared to contemporary models, in a way that internal combustion engine (ICE) models perhaps would not be.

This can chiefly be chalked up to battery technology. For reference, where EVs would deliver 300 to 400km of range a few years back, today we are seeing EVs capable of 500-700km, and even 400+ on your more entry-level models.

For ICE models, used, five-year old models would typically lose out in terms of equipment and perhaps a little bit of performance, but the car's 'basic' capabilities are largely still on-par. Considering that range is quite fundamental to an EV's capabilities, a significant drop-off in range would certainly give customers pause when buying a used model.

Another reason ca be chalked up to general uncertainty when it comes to EVs. Since EVs are still relatively 'new', buyers may be more cautious about them in the used car market, and may thus still gravitate towards more 'traditional' models.

Models like the Tesla Model 3 and Porsche Taycan are often available in the used car market, but every car's original price (and consequently resale price) fluctuates according to COE

Analysing Singapore

What about Singapore?

For starters, trying to identify and map out the "resale value" of EVs in Singapore is much more complex when compared to other markets, and that's intrinsically tied to the COE system.

In other markets, a car's value is a more straightforward calculation, as the car has more or less a determined 'price', even with taxes factored in.

Here in Singapore, it's not so simple. Because of the fluctuating nature of COE, two identical new cars may in fact have very different 'pricetags' depending on when they were purchased (or registered, to be precise), which thus makes calculating across-the-board value depreciation for any model quite tricky.

Is there a way? There probably is, but it'll requires a hellish amount of math that I'm not sure I am actually able to do.

So, how do we make sense of the used passenger car EV market here?

Taking a look at listings

Thankfully, we have other potential data points, helped in no small part by the fact that Sgcarmart hosts a majority of used car listings (and facilitates a majority of transactions) here in Singapore. This allows us to dig a little deeper into the listings and see if certain patterns emerge.

One option is to look at the average duration of used car listings, and identifying the duration between when a used car is listed, and when it is sold. This can give us an effective idea of how long a car is "on the market" - with the assumption that quicker turnover is indicative of greater buyer demand.

Looking at data from 2023 through to Mar 2024 (based on a car's listed date), there were 905 used EVs transacted on Sgcarmart, with an average duration of 71.8 days between listed date and transacted date, and a median of 48.5.

In the same 15-month period, 90,760 non-electric used cars were transacted, with an average duration of 53.7 days between listed date and transacted date, and a median of 34.

On this data point alone, we can see that turnover of a used EV is considerably longer than a used non-EV, about 33% longer.

Breakdown of listing duration by number of days

If we look more closely at the data, we can also sort the listings by number of days, grouped into 7-day segments, with an upper bound of 'more than 6 weeks'.

With EVs, we can see that the largest percentage is from 15 to 21 days, with comparable and similar percentages for the '1 to 7' and '8 to 14' segments. Also, less than half of all transactions take place within 6 weeks.

For comparison, for non-EVs, the highest percentage is for the '1 to 7' segment, which indicates much quicker turnover of cars within 7 days of listing. Additionally, more than half of all transactions take place within 6 weeks.

Drawing relevant conclusions

While it's hard to do a direct price analysis of used EVs given the volatile and ever-changing nature of prices and "value", a look at transactions show us that EVs tend to be more 'sticky' on the used car market.

Of course, we do also have to recognise that because of the disparity in size of data sets (there is almost exactly 100x more data on non-EVs), there may be some risk of sample size fallacy.

Representatives from used car dealers Sphere Automobile and SgCarChoice acknowledge that EVs tend to take longer to be sold compared to non-EVs

In speaking to several used car dealers that have EVs in their inventories, the responses have been mixed. Some concur that EVs are generally harder to move compared to non-EVs. Representatives from Sphere Automobile and CarChope SG acknowledge that EV tend to take longer to be sold compared to non-EVs, while a representative from SgCarChoice tells us that “the demand for non-EV used cars is still much higher than EVs”. Several dealers acknowledge that while there is growing demand for EVs, even used ones, concerns about battery life and charging infrastructure are still front-of-mind for customers.

A representative from Octane Motors also highlights a challenge: "The price of a brand new EV unit is very competitive, and it might actually be cheaper buying brand new".

However, several also point out that in the used car market, it's about "matching the buyer to the correct car at the correct price point", true for both EVs and non-EVs. A representative from First Exclusive Motoring tells us that "it seems that EVs have their own target audience […] if the price is right, the turnaround time is about the same as non-EVs".

It's worth considering what this means for Singapore, at least right now in 2024. While we cannot say for certain that used EV values are falling, we can at least statistically acknowledge that EVs are harder to move in the used car market when compared to non-EVs.

Of course, Singapore is still in the relatively early stages of electrification. As more new EVs come to market (and then eventually enter the used car market), and with growing infrastructure availability, we may eventually see this gap narrow. But as of right now, the numbers still indicate that used EVs are slower to sell in Singapore when compared against non-EVs.

Thank You For Your Subscription.