Things to look out for when buying online car insurance

19 Oct 2024|714 views

It's the year 2024 now, and almost everything can be done online, with zero person-to-person interaction. From shopping for items online, to food and groceries, they can all be ordered and delivered to your place without any contact.

The ability to buy things online is not only a godsend for introverts who want to avoid interaction with a stranger, it also offers many benefits such as the flexibility to browse and shop at any time of the day you want. And that is why you might find yourself being intrigued by the idea of buying car insurance online. If this is the first time that you want to apply for car insurance online, it might seem a little daunting, but worry not, this is the article you need.

What are the benefits of buying car insurance online?

There are a few ways to go about getting your car insurance - the traditional way is to go to an agent, and provide them with the necessary information. The agent will then get back to you with a quote, and you decide if you want to go ahead with the process. This can typically be done over the phone, but there will be some lead time depending on how efficient your agent is.

The main benefits of buying your car insurance online is time, convenience and potential savings.

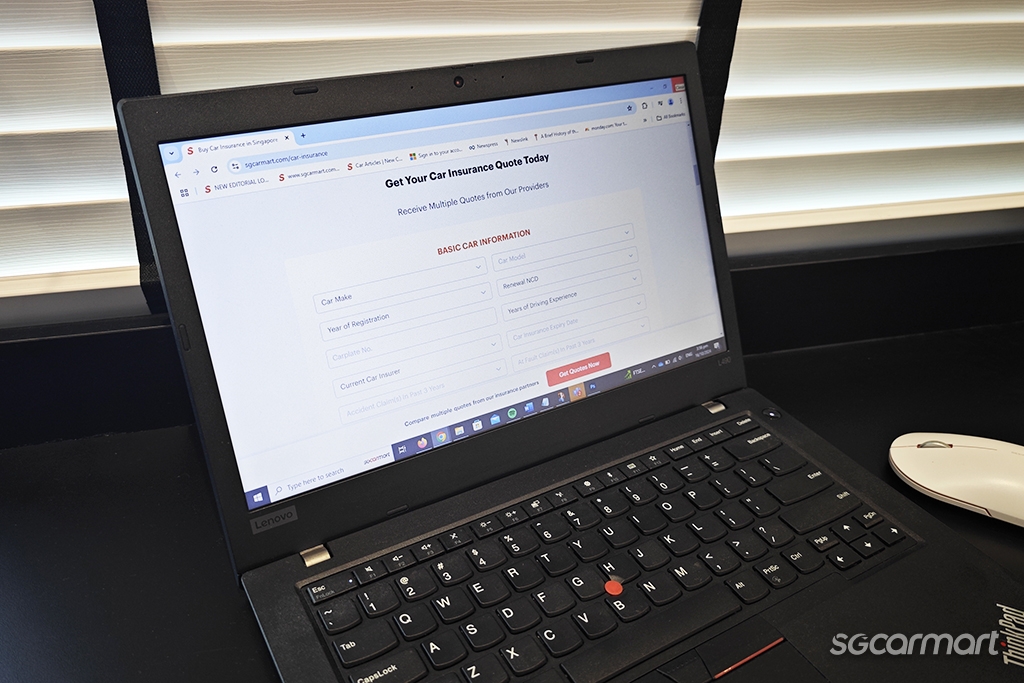

Buying your car insurance online has the potential to make things even simpler - most companies will also allow you to log in with your Singpass to retrieve your details

Yes, using your phone to call the insurance agent or broker isn't exactly hard work. But if you were to search for a car insurance policy online, you can get immediate quotations by completing the forms on each insurer's website. Additionally, if you want to go ahead with applying for your car insurance online, you'll just need to provide all the relevant information (most will also allow you to log in with Singpass for a hassle-free process) and make payment online. Most companies would be able to process your online car insurance application within the next working day.

By buying your car insurance online, you are dealing directly with the insurance company. Without a middleman, there are potential savings to be made as the insurance company would not have to pay out a commission.

Should I use an insurance broker?

Apart from insurance agents and buying car insurance online directly, there is a third popular option - using an insurance broker. An insurance broker works like an insurance aggregator: they will present you with quotes across various insurers for you to make an informed decision.

So, why should you consider using an insurance broker? Well, unlike insurance agents who might be representing a specific insurer, there could be potential savings when you get to compare quotes from different insurance companies. Like using an insurance agent, insurance brokers also get a commission for their service rendered.

However, if you are internet savvy and willing to spend some time behind the computer (or using your smartphone), you can still compare the quotes from various online car insurance providers and make even more savings.

As with any purchase, there are always steps that you should take to ensure your safety when applying for your car insurance online

Is it safe to buy your car insurance online?

As with all online purchases, there are some steps that you should take to ensure your safety when applying for your car insurance online. First, you should check to ensure that the insurance company is a legitimate one - you could go to LTA's One Motoring website for a list of motor insurance companies.

Next, you must always ensure the legitimacy of the website to avoid falling into phishing scams - avoid clicking on suspicious links, always research online and double check the website before entering your information or making any payment.

So, yes, by being careful and doing the necessary checks before proceeding, buying your car insurance online is safe.

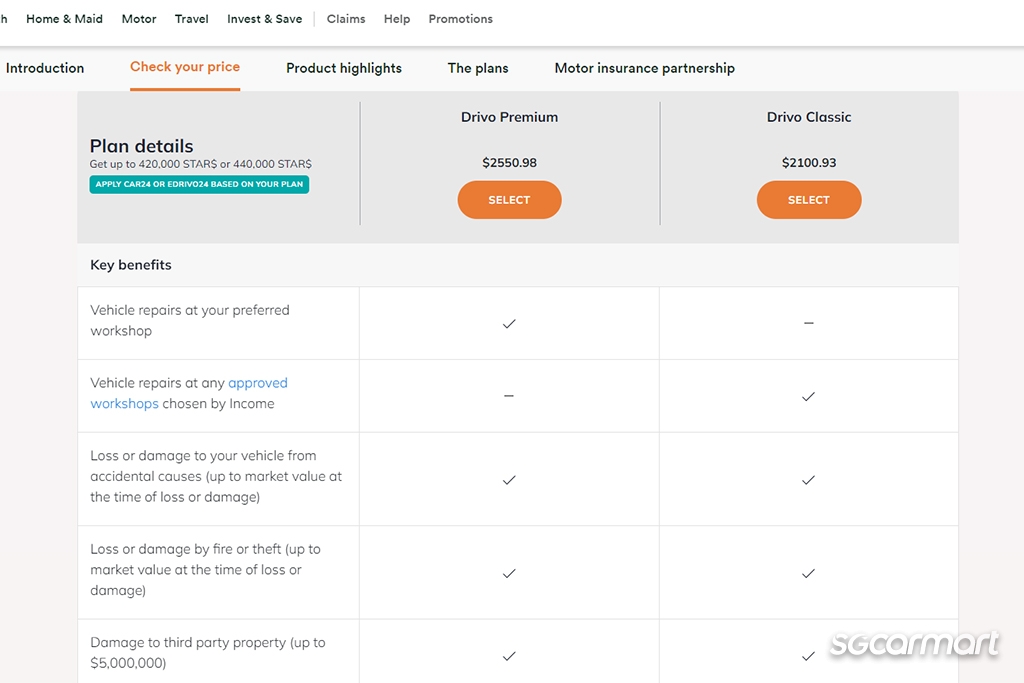

However, one downside of buying your own car insurance online, instead of approaching an insurance agent or a broker, is that you'll have to read and understand the coverage and terms and conditions yourself. Of course, most websites are built with chat features should you require clarifications. While most car insurance policies offered, be it online or offline, will allow you to drive on Singapore roads, the degree of coverage could differ.

Finer details such as windscreen protection, replacement vehicle in case of total loss, the workshops that you are restricted to in case of an accident, insurance excess, named or unnamed driver coverage and many others could differ from one policy to another. These are all points that you should carefully consider and compare when choosing the online insurance company to go with.

How to apply for your car insurance online?

Alright, now that you are familiar with the pros and cons of buying car insurance online, you can decide if you want to buy your own car insurance online, or take it offline and approach an insurance agent or broker.

If you choose to get your car insurance online, the process is typically very simple. Most online car insurers would have forms for you to fill up to apply for the insurance. The information that you need can all be accessed using your NRIC and Singpass. By logging into One Motoring with your Singpass, you'll be able to retrieve your vehicle log card, which has all the information needed.

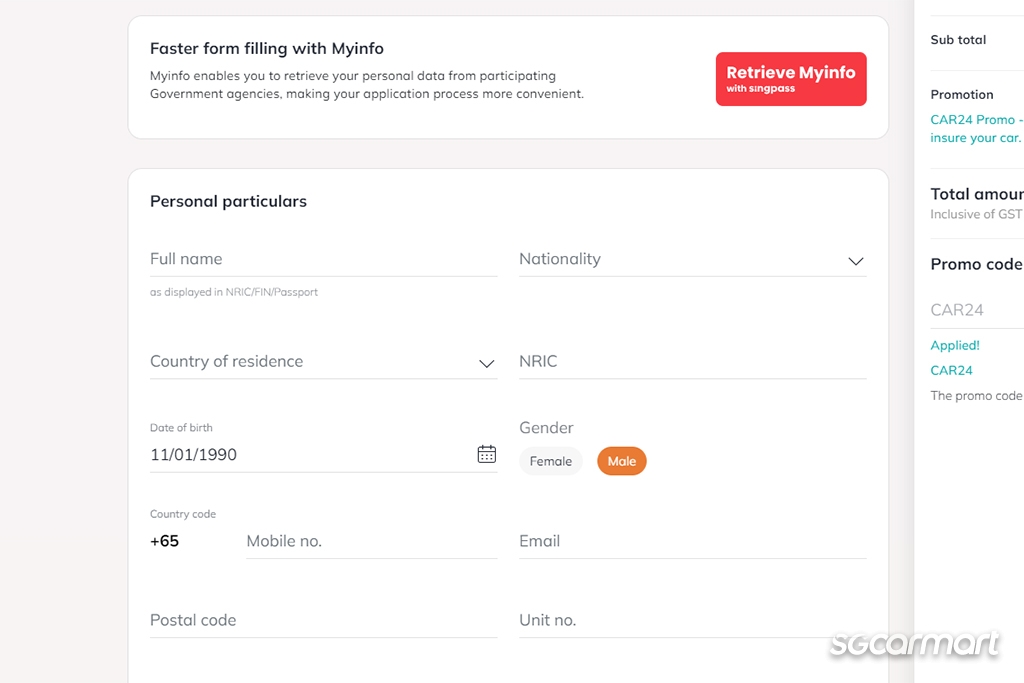

In fact, some online insurance websites makes things simpler with Myinfo - you can simply log in with your Singpass and all the required information will be retrieved automatically, without the need for you to enter your details manually.

With all the required information, you can then make the payment online. After your car's insurance has been approved and processed, the insurer will then email you your car insurance certificate.

And that's it, you have successfully applied for and bought your car's insurance online.

It's the year 2024 now, and almost everything can be done online, with zero person-to-person interaction. From shopping for items online, to food and groceries, they can all be ordered and delivered to your place without any contact.

The ability to buy things online is not only a godsend for introverts who want to avoid interaction with a stranger, it also offers many benefits such as the flexibility to browse and shop at any time of the day you want. And that is why you might find yourself being intrigued by the idea of buying car insurance online. If this is the first time that you want to apply for car insurance online, it might seem a little daunting, but worry not, this is the article you need.

What are the benefits of buying car insurance online?

There are a few ways to go about getting your car insurance - the traditional way is to go to an agent, and provide them with the necessary information. The agent will then get back to you with a quote, and you decide if you want to go ahead with the process. This can typically be done over the phone, but there will be some lead time depending on how efficient your agent is.

The main benefits of buying your car insurance online is time, convenience and potential savings.

Buying your car insurance online has the potential to make things even simpler - most companies will also allow you to log in with your Singpass to retrieve your details

Yes, using your phone to call the insurance agent or broker isn't exactly hard work. But if you were to search for a car insurance policy online, you can get immediate quotations by completing the forms on each insurer's website. Additionally, if you want to go ahead with applying for your car insurance online, you'll just need to provide all the relevant information (most will also allow you to log in with Singpass for a hassle-free process) and make payment online. Most companies would be able to process your online car insurance application within the next working day.

By buying your car insurance online, you are dealing directly with the insurance company. Without a middleman, there are potential savings to be made as the insurance company would not have to pay out a commission.

Should I use an insurance broker?

Apart from insurance agents and buying car insurance online directly, there is a third popular option - using an insurance broker. An insurance broker works like an insurance aggregator: they will present you with quotes across various insurers for you to make an informed decision.

So, why should you consider using an insurance broker? Well, unlike insurance agents who might be representing a specific insurer, there could be potential savings when you get to compare quotes from different insurance companies. Like using an insurance agent, insurance brokers also get a commission for their service rendered.

However, if you are internet savvy and willing to spend some time behind the computer (or using your smartphone), you can still compare the quotes from various online car insurance providers and make even more savings.

As with any purchase, there are always steps that you should take to ensure your safety when applying for your car insurance online

Is it safe to buy your car insurance online?

As with all online purchases, there are some steps that you should take to ensure your safety when applying for your car insurance online. First, you should check to ensure that the insurance company is a legitimate one - you could go to LTA's One Motoring website for a list of motor insurance companies.

Next, you must always ensure the legitimacy of the website to avoid falling into phishing scams - avoid clicking on suspicious links, always research online and double check the website before entering your information or making any payment.

So, yes, by being careful and doing the necessary checks before proceeding, buying your car insurance online is safe.

However, one downside of buying your own car insurance online, instead of approaching an insurance agent or a broker, is that you'll have to read and understand the coverage and terms and conditions yourself. Of course, most websites are built with chat features should you require clarifications. While most car insurance policies offered, be it online or offline, will allow you to drive on Singapore roads, the degree of coverage could differ.

Finer details such as windscreen protection, replacement vehicle in case of total loss, the workshops that you are restricted to in case of an accident, insurance excess, named or unnamed driver coverage and many others could differ from one policy to another. These are all points that you should carefully consider and compare when choosing the online insurance company to go with.

How to apply for your car insurance online?

Alright, now that you are familiar with the pros and cons of buying car insurance online, you can decide if you want to buy your own car insurance online, or take it offline and approach an insurance agent or broker.

If you choose to get your car insurance online, the process is typically very simple. Most online car insurers would have forms for you to fill up to apply for the insurance. The information that you need can all be accessed using your NRIC and Singpass. By logging into One Motoring with your Singpass, you'll be able to retrieve your vehicle log card, which has all the information needed.

In fact, some online insurance websites makes things simpler with Myinfo - you can simply log in with your Singpass and all the required information will be retrieved automatically, without the need for you to enter your details manually.

With all the required information, you can then make the payment online. After your car's insurance has been approved and processed, the insurer will then email you your car insurance certificate.

And that's it, you have successfully applied for and bought your car's insurance online.